I. INTRODUCTION

Mastering the Fundamentals of Order Types

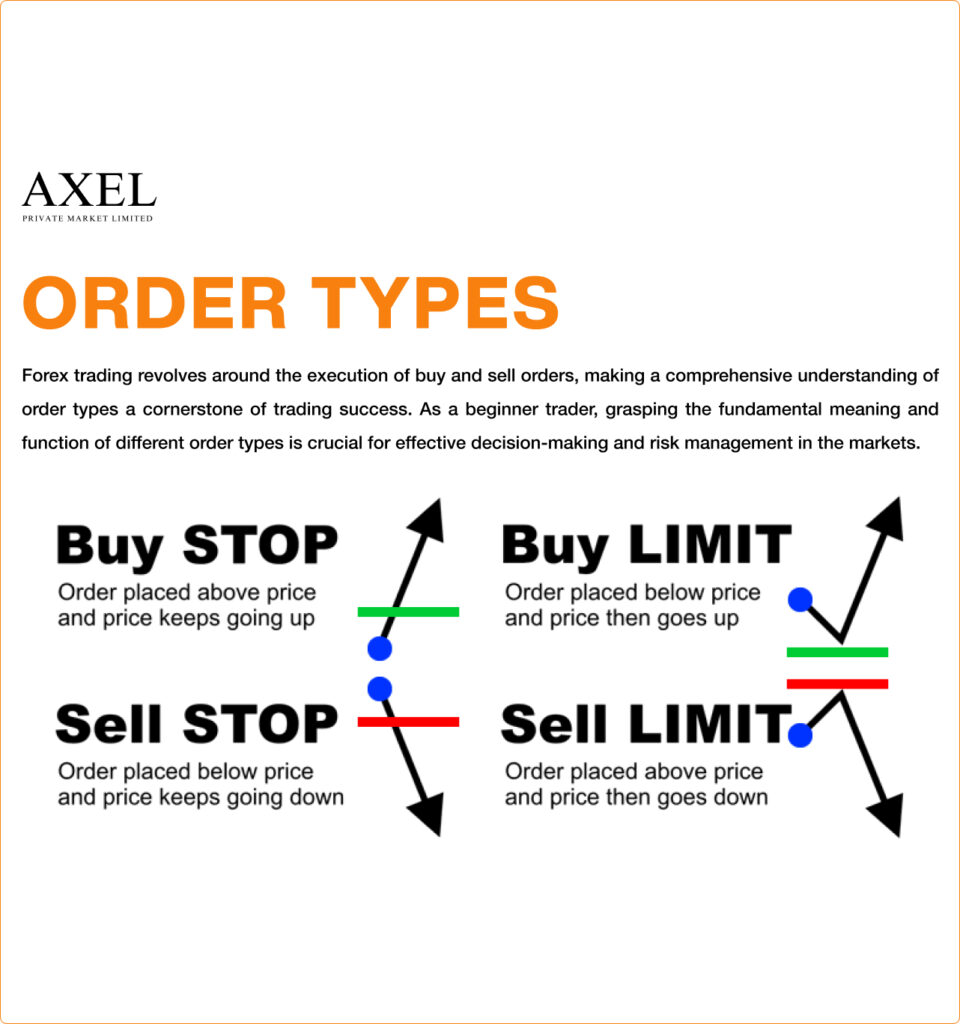

Forex trading revolves around the execution of buy and sell orders, making a comprehensive understanding of order types a cornerstone of trading success. As a beginner trader, grasping the fundamental meaning and function of different order types is crucial for effective decision-making and risk management in the markets.

Beyond just defining the terminology, comprehending how order types are interpreted and processed by the trading platform is key to ensuring your trades are executed as intended. This knowledge forms the foundation for developing a shared vocabulary and trading framework that will serve you well as you navigate the dynamic Forex landscape.

Objectives of This Topic

The primary objective of this topic is to provide you with the fundamental knowledge necessary to master the basics of order types and execution in Forex trading. By the end of this discussion, you will have a clear understanding of:

- The various order types available, their definitions, and characteristics.

- How to effectively place and execute each type of order.

- The advantages and disadvantages associated with different order types.

- The key factors that can influence the successful execution of your orders.

- Strategies for combining order types to enhance your trading approach.

- Best practices for managing and monitoring your open orders.

Armed with this comprehensive understanding, you will be well-equipped to navigate the Forex markets with confidence and make informed trading decisions.

II. BASIC ORDER TYPES

In the world of Forex trading, understanding the various order types and their execution is paramount. Let’s delve into the fundamental building blocks that enable you to navigate the markets with precision and confidence.

1. Market Order

Definition and Characteristics:

A market order is a directive to buy or sell a currency pair at the best available price in the current market conditions. These orders are executed immediately and at the current market rate, making them the fastest way to enter or exit a position.

Placing and Executing Market Orders:

Executing a market order is a straightforward process. When you submit a market order, your trading platform will automatically match your order with the best available bid or ask price in the market, regardless of the specific price level. This ensures your order is filled promptly, but it also means you may not receive the exact price you anticipated.

Advantages and Disadvantages:

The primary advantage of a market order is its speed of execution, which can be crucial in volatile or fast-moving markets. However, the trade-off is that you may not get the exact price you were hoping for, as the final execution price can vary slightly from the price you saw when you placed the order.

2. Limit Order

Definition and Characteristics:

A limit order is an instruction to buy or sell a currency pair at a specific price or better. This order type allows you to set a target price and will only be executed if the market reaches that level or surpasses it in your favor.

Placing and Executing Limit Orders:

When you place a limit order, you specify the price at which you are willing to buy or sell. Your order will then be executed only if the market reaches that price or a more favorable one. Limit orders provide you with better control over your entry and exit prices, but they may not always be filled if the market fails to reach the specified level.

Advantages and Disadvantages:

The primary advantage of a limit order is that it allows you to potentially buy or sell at a more favorable price than the current market rate. However, the trade-off is that your order may not be executed if the market does not reach the specified price level, which can be a disadvantage in fast-moving or volatile markets.

3. Stop Order

Definition and Characteristics:

A stop order is an instruction to buy or sell a currency pair when the market reaches a specific price level. This order type is often used as a risk management tool, as it can help you limit potential losses by automatically closing a position once a certain price is reached.

Placing and Executing Stop Orders:

When you place a stop order, you specify the price level at which you want the order to be triggered. Once the market reaches that price, your order will be converted into a market order and executed at the best available price. Stop orders can be used to enter new positions or exit existing ones, depending on your trading strategy.

Advantages and Disadvantages:

The primary advantage of a stop order is that it can help you manage your risk by automatically closing a position if the market moves against you. However, the trade-off is that your order may be executed at a less favorable price than you originally anticipated, especially in highly volatile market conditions.

4. Trailing Stop Order

Definition and Characteristics:

A trailing stop order is a special type of stop order that automatically adjusts the stop price as the market moves in your favor. This order type allows you to lock in profits while also protecting your downside risk.

Placing and Executing Trailing Stop Orders:

When you place a trailing stop order, you specify the distance (in pips or currency units) that the stop price should trail behind the current market price. As the market moves in your favor, the stop price will be automatically updated to maintain the specified distance, effectively “trailing” the market. However, if the market moves against you, the stop price will remain fixed, ensuring your position is closed at a predetermined level.

Advantages and Disadvantages:

The primary advantage of a trailing stop order is that it allows you to capitalize on favorable market movements while also limiting your downside risk. However, the trade-off is that your order may be executed at a less favorable price than you originally anticipated if the market experiences sudden, volatile swings.

By understanding the nuances of these basic order types, you’ll be better equipped to navigate the Forex market and make informed trading decisions that align with your risk tolerance and trading strategy.

III. FACTORS AFFECTING ORDER EXECUTION

Executing orders in the Forex market is a nuanced process, with various factors influencing the speed, price, and overall success of your trades. As a Forex trader, understanding these key elements is crucial for optimizing your order execution and achieving your trading objectives.

Market Liquidity

The level of market liquidity refers to the ease with which a currency pair can be bought or sold without significantly affecting its price. Highly liquid markets, such as the major currency pairs, typically have a large number of active buyers and sellers, facilitating smooth and efficient order execution.

In a highly liquid market, your orders are more likely to be filled at or near your desired price, as there are ample counter-parties willing to take the opposite side of your trade. Conversely, in less liquid markets, your orders may experience wider bid-ask spreads and slower execution times, potentially resulting in less favorable pricing.

Market liquidity is a crucial consideration within the broader context of Forex trading, as it directly impacts your ability to enter and exit positions at your preferred levels. Understanding the liquidity profile of the currency pairs you trade is essential for managing risk and optimizing your order execution strategy.

Price Volatility

How does the level of price volatility in the Forex market affect the execution of your orders? Periods of high volatility, characterized by rapid and unpredictable price movements, can pose challenges for order execution.

During times of increased volatility, the bid-ask spread may widen, and the market may move quickly past your specified price levels before your order can be filled. This can result in your orders being executed at less favorable prices than you anticipated.

The relationship between price volatility and order execution is a crucial consideration. Volatile market conditions can cause the underlying structure of order types to behave differently, with market orders potentially experiencing more slippage and limit orders having a lower probability of being filled.

Order Timing

The timing of when you place your orders can also impact their execution. Orders submitted during periods of high trading activity, such as around major economic releases or during the most liquid trading sessions, may be filled more quickly and at better prices than orders placed during periods of lower liquidity.

Order timing should be considered within the broader context of your trading strategy and risk management practices. Placing orders at strategic times can help you take advantage of market conditions and improve the overall efficiency of your trading execution.

Trading Fees

The trading fees charged by your Forex broker can also influence the execution of your orders. Higher fees may result in less favorable pricing, as the broker’s commission or spread is factored into the final execution price. Understanding the fee structure of your chosen broker is crucial for accurately calculating the true cost of your trades.

By carefully considering these key factors – market liquidity, price volatility, order timing, and trading fees – you can make more informed decisions about order placement and execution, ultimately enhancing your chances of achieving successful trades in the Forex market.

IV. COMBINING ORDER TYPES

In the dynamic Forex market, the strategic combination of various order types can help you enhance your trading performance and manage risk more effectively. By leveraging the unique characteristics of different order types, you can tailor your execution strategies to align with your trading objectives and market conditions.

Utilizing Market Orders with Stop Loss and Take Profit

When placing a market order, you can pair it with stop loss and take profit orders to define your risk tolerance and target profit levels. This approach allows you to quickly enter the market at the prevailing rate while also setting predetermined levels to automatically close your position.

The stop loss order serves as a protective measure, limiting your potential downside by automatically closing your position if the market moves against you. Conversely, the take profit order enables you to lock in gains by automatically closing your position once the market reaches your desired profit target.

This combination of order types is often employed by traders who prioritize speed of execution and want to limit their risk exposure while also securing potential profits. It is a common strategy used in volatile or fast-moving market conditions.

Utilizing Limit Orders with Stop Loss and Take Profit

How can you use limit orders in conjunction with stop loss and take profit orders to refine your trading approach? By leveraging this combination, you can potentially enter positions at more favorable prices while still managing your risk and targeting specific profit levels.

When placing a limit order, you can set a stop loss order to protect against adverse market movements and a take profit order to automatically close your position once your desired profit target is reached. This strategy allows you to be more selective about your entry prices while still defining your risk and reward parameters.

The structural relationship between limit orders, stop loss, and take profit orders creates a comprehensive trading setup that can be tailored to your individual risk profile and market expectations. By understanding the lexical meaning and interaction of these order types, you can construct trading plans that align with your overall trading strategy.

Examples of Trading Scenarios and Order Usage

To illustrate the practical application of combining order types, let’s consider the following examples:

- Buying the Dip: You identify a potential support level and want to enter a long position. You could place a limit buy order at a specific price level, coupled with a stop loss order below the support and a take profit order at your targeted resistance level.

- Breakout Trading: You anticipate a currency pair to break out of a consolidation pattern. You could place a buy stop order above the resistance level, with a stop loss order below the support and a take profit order at your identified profit target.

- Trend Trading: You believe a currency pair is in a strong uptrend and want to participate. You could place a series of limit buy orders at incrementally higher price levels, each with its own stop loss and take profit orders to manage your risk and capture potential gains.

By understanding the nuances of these order type combinations, you can tailor your trading strategies to the specific market conditions and your personal risk-reward preferences.

V. MANAGING TRADE ORDERS

Effective order management is a crucial aspect of Forex trading, as it enables you to adapt to changing market conditions, mitigate risks, and seize opportunities as they arise. In this section, we’ll delve into the best practices for monitoring, adjusting, and closing your trade orders.

Monitoring and Adjusting Orders

As a Forex trader, it’s essential to actively monitor your open orders and be prepared to make timely adjustments as needed. This involves closely tracking the market’s price movements and the execution status of your orders to ensure they align with your trading strategy.

By monitoring your orders, you can identify opportunities to modify their parameters, such as adjusting the price levels or order types, to better suit the current market environment. This flexibility allows you to respond to evolving market conditions and potentially improve the execution of your trades.

Order monitoring and adjustment should be viewed within the broader context of risk management and trade optimization. Regularly reviewing your open positions and being proactive in managing your orders can help you reduce losses, protect profits, and enhance your overall trading performance.

Handling Partially Filled Orders

What happens when your order is only partially filled in the Forex market? Understanding how to manage these situations is crucial for maintaining control over your trading activities and minimizing potential losses.

When a limit or stop order is only partially filled, the remaining portion of the order will remain open, awaiting further market movements to potentially be executed. As a trader, you have the option to either leave the remaining order in the market or cancel and re-submit it with adjusted parameters, depending on your trading strategy and market conditions.

The structural relationship between the partially filled order and the remaining open portion is an important consideration. The way you choose to handle a partially filled order can significantly impact the overall success of your trading strategy and your ability to manage risk effectively.

Closing Orders and Taking Profits/Losses

The final stage of order management involves closing your open positions and realizing your trading outcomes, whether they are profits or losses. This process requires a clear understanding of the different order types and their execution mechanics to ensure you achieve your desired results.

Closing orders should be viewed within the broader context of your overall trading plan and risk management framework. Factors such as your profit targets, stop-loss levels, and portfolio diversification should all be considered when deciding to close a trade and lock in your gains or losses.

By mastering the techniques for monitoring, adjusting, and closing your trade orders, you can enhance your adaptability and decision-making in the Forex market. This level of order management proficiency will empower you to navigate the dynamic market conditions with confidence and increase your chances of achieving consistent trading success.

VI. CONCLUSION

In the dynamic world of Forex trading, understanding and effectively utilizing order types is a fundamental skill that can significantly impact your trading success. Let’s summarize the key takeaways from our exploration of this essential topic.

The Pivotal Role of Order Types

Order types serve as the building blocks of your trading strategies, allowing you to enter, manage, and exit positions with precision and control. Mastering the nuances of different order types, such as market orders, limit orders, stop orders, and trailing stop orders, is crucial for navigating the Forex market with confidence.

By familiarizing yourself with the precise definitions and characteristics of each order type, you can develop a shared vocabulary and trading framework that enables clear communication and informed decision-making.

Order types should be viewed within the broader context of risk management, trade execution, and overall trading strategy. Leveraging the unique features of various order types can help you optimize your trading approach and adapt to evolving market conditions.

Key Considerations When Using Order Types

What factors should you keep in mind when utilizing different order types in the Forex market? Considerations such as market liquidity, price volatility, order timing, and trading fees can all significantly impact the execution and outcomes of your trades.

By understanding how these factors influence the performance of your orders, you can make more informed decisions and fine-tune your trading strategies to maximize your chances of success.

The interplay between various order types and the structural relationship of their components (e.g., limit orders with stop loss and take profit) can create powerful trading setups that align with your risk profile and market expectations.

Continuous Learning and Practice

Mastering the intricacies of order types is an ongoing process that requires a commitment to learning and consistent practice. As you continue to explore and experiment with different order type combinations, you’ll develop a deeper understanding of their applications and adaptability within the Forex market.

Embracing a growth mindset and a dedication to honing your order management skills will empower you to navigate the Forex market with greater confidence, agility, and ultimately, improved trading outcomes.

Remember, the knowledge and insights shared in this guide are just the beginning of your journey to becoming a proficient Forex trader. Keep exploring, practicing, and seeking out additional resources to further refine your understanding and application of order types.

FAQs

As you continue your Forex trading journey, you may encounter various questions or concerns related to order types and their execution. Feel free to refer to the following FAQs for clarification and additional guidance:

- Q: How do I determine the most suitable order type for a particular trading scenario?

- Q: What are the best practices for managing partially filled orders?

- Q: How can I effectively combine order types to enhance my trading strategy?

- Q: What are the potential risks associated with using certain order types, and how can I mitigate them?

By keeping these key considerations in mind and maintaining a commitment to continuous learning, you’ll be well on your way to mastering the art of order type utilization in the Forex market.