INTRODUCTION TO FOREX TRADING HOURS

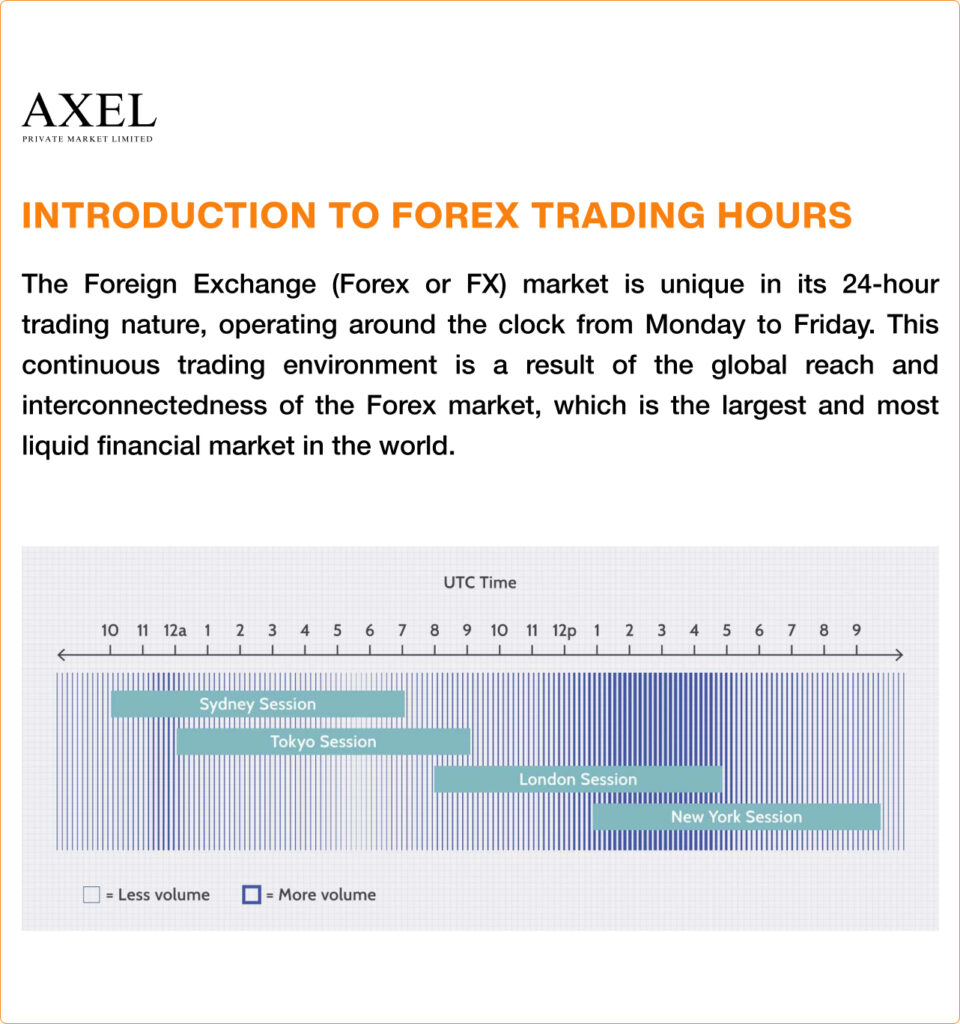

The Foreign Exchange (Forex or FX) market is unique in its 24-hour trading nature, operating around the clock from Monday to Friday. This continuous trading environment is a result of the global reach and interconnectedness of the Forex market, which is the largest and most liquid financial market in the world.

The Three Major Forex Trading Sessions

The Forex market is segmented into three main trading sessions, each corresponding to a different region of the world:

- Asian Session (or Tokyo Session): This session is primarily driven by trading activity in the Asia-Pacific region, including major financial centers such as Tokyo, Sydney, and Hong Kong. The Asian session typically runs from 00:00 UTC to 09:00 UTC.

- European Session (or London Session): The European session is the busiest and most volatile part of the Forex trading day, with London being the epicenter of global Forex trading. This session runs from 08:00 UTC to 17:00 UTC.

- North American Session (or New York Session): The North American session is the final major trading session of the day, with New York being the primary driver of activity. This session runs from 13:00 UTC to 22:00 UTC.

Importance of Understanding Forex Trading Hours

Knowing the Forex trading hours and the dynamics of each session is crucial for effective order placement and risk management. Here’s why understanding Forex trading hours is important:

- Liquidity and Volatility: The various trading sessions have different levels of liquidity and volatility, which can impact trade execution and pricing. Traders can leverage the increased activity and volatility during the overlapping sessions to their advantage.

- Order Placement Strategies: Traders can time their order placements to coincide with specific trading sessions, taking advantage of the unique characteristics of each session (e.g., placing orders during the most liquid and active periods).

- Economic Releases and Market Events: Many high-impact economic releases and market events are scheduled during specific trading sessions. Knowing the trading hours allows traders to prepare and manage their positions around these events.

- Circadian Rhythm and Personal Productivity: Understanding the Forex trading hours can help traders optimize their daily routines and schedule to maintain peak performance and avoid fatigue during the most active trading periods.

By comprehending the 24-hour nature of the Forex market and the nuances of each trading session, traders can develop more effective order placement strategies, manage their risk more effectively, and capitalize on the unique opportunities presented by the global Forex market.

OREX MARKET OPENING AND CLOSING TIMES

The Forex market operates 24 hours a day, 5 days a week, with each major trading session having its own specific opening and closing times. Understanding these session times is crucial for traders to effectively plan and execute their trading strategies.

Major Forex Trading Session Times

- Asian Session (Tokyo Session):

- Opening Time: 00:00 UTC

- Closing Time: 09:00 UTC

- European Session (London Session):

- Opening Time: 08:00 UTC

- Closing Time: 17:00 UTC

- North American Session (New York Session):

- Opening Time: 13:00 UTC

- Closing Time: 22:00 UTC

It’s important to note that these times are based on the Coordinated Universal Time (UTC) standard, which is a widely accepted time reference for the global financial markets.

Time Zone Conversions in Forex Trading

Since Forex is a global market, traders need to be mindful of time zone differences when planning their trading activities. Failing to account for time zone differences can lead to confusion and missed trading opportunities.

To convert the Forex trading session times to your local time zone, you can use the following formula:

Local Time = UTC Time + Time Zone Offset

For example, if you’re located in New York (Eastern Time Zone, UTC-4), the Forex trading session times would be:

- Asian Session (Tokyo Session):

- Opening Time: 20:00 EDT (UTC-4)

- Closing Time: 05:00 EDT (UTC-4)

- European Session (London Session):

- Opening Time: 04:00 EDT (UTC-4)

- Closing Time: 13:00 EDT (UTC-4)

- North American Session (New York Session):

- Opening Time: 09:00 EDT (UTC-4)

- Closing Time: 18:00 EDT (UTC-4)

Understanding the Forex market’s trading session times and accurately converting them to your local time zone is essential for managing your trading activities, monitoring market developments, and aligning your trading strategies with the most active and liquid periods in the Forex market.

UNDERSTANDING FOREX MARKET LIQUIDITY CYCLES

The Forex market, being a 24-hour global market, experiences fluctuations in liquidity and volatility throughout the trading day. Recognizing these liquidity cycles is crucial for traders to optimize their order placement and trading strategies.

Peaks and Lulls in Forex Market Liquidity

- Asian Session (Tokyo Session): The Asian session typically starts with relatively lower liquidity, as the European and North American markets are closed. Liquidity gradually increases as the session progresses, reaching its peak during the overlap with the European session.

- European Session (London Session): The European session is characterized by the highest liquidity and volatility in the Forex market. This is due to the convergence of major financial centers, such as London, Paris, and Frankfurt, during this time.

- North American Session (New York Session): The North American session sees an increase in liquidity and volatility as the European session winds down and the US markets open. The overlap between the European and North American sessions is another highly active and liquid period in the Forex market.

- Overnight/Weekend Periods: During the overnight and weekend periods, when major financial centers are closed, Forex liquidity tends to be lower, and the market can experience wider bid-ask spreads and increased volatility.

Identifying the Most Active and Volatile Trading Periods

The most active and volatile trading periods in the Forex market typically occur during the overlapping sessions, such as:

- Asian/European Session Overlap: The period between 08:00 UTC and 11:00 UTC, when the Asian and European sessions overlap, is generally considered the most liquid and volatile part of the trading day.

- European/North American Session Overlap: The period between 13:00 UTC and 17:00 UTC, when the European and North American sessions overlap, is also a highly active and volatile time in the Forex market.

Understanding these liquidity cycles and the most active trading periods can help traders make more informed decisions about order placement, trade entry and exit points, and risk management. By aligning their trading activities with the most liquid and volatile periods, traders can potentially improve their chances of successful trades and better manage the risks associated with the Forex market.

OPTIMIZING ORDER PLACEMENT BASED ON TRADING HOURS

Effective order placement is a crucial aspect of successful Forex trading, and understanding the dynamics of the Forex market’s trading hours can significantly enhance your trading strategies. Here are some strategies for optimizing order placement based on the different trading sessions.

Strategies for Entering and Exiting Trades

- Asian Session (Tokyo Session):

- Focus on entry and exit points during the session overlap with the European session (08:00 UTC to 11:00 UTC) when liquidity and volatility are higher.

- Consider trading Asian-centered currency pairs, such as USD/JPY, AUD/JPY, or USD/CNH, as they tend to be more active during this session.

- European Session (London Session):

- Place trades during the peak liquidity period of the European session (08:00 UTC to 17:00 UTC) to take advantage of tighter spreads and increased market activity.

- Monitor major economic releases and central bank announcements from European countries, as they can significantly impact the Forex market during this session.

- North American Session (New York Session):

- Focus on entry and exit points during the overlap between the European and North American sessions (13:00 UTC to 17:00 UTC) for increased volatility and liquidity.

- Consider trading the US dollar-denominated currency pairs, such as EUR/USD, GBP/USD, or USD/CHF, as they tend to be more active during this session.

Leveraging Increased Volatility and Liquidity During Overlap Periods

The overlap periods between the trading sessions, such as the Asian/European and European/North American overlaps, are generally the most liquid and volatile parts of the Forex trading day. Traders can leverage these characteristics to their advantage:

- Increased Liquidity: During the overlap periods, the Forex market experiences a surge in trading volume and tighter bid-ask spreads, which can lead to more efficient order executions and potentially better pricing.

- Higher Volatility: The increased market activity during the overlap periods often results in heightened price swings, providing opportunities for traders to capitalize on short-term market movements through strategies like scalping or range trading.

- Trend Continuation and Breakouts: The overlap periods can also be conducive to trend-following or breakout trading strategies, as the increased liquidity and volatility can facilitate the continuation or acceleration of existing market trends.

By aligning your order placement strategies with the unique characteristics of each Forex trading session and leveraging the opportunities presented during the overlap periods, you can potentially improve your chances of successful trades and better manage the risks inherent in the Forex market.

PLACING ORDERS AROUND MAJOR ECONOMIC RELEASES

The Forex market is highly sensitive to the release of economic data and news events, as these can significantly impact the valuation of currencies and the overall market sentiment. Understanding how to manage your order placement around these high-impact events is crucial for successful Forex trading.

Identifying High-Impact Economic Events

Some of the key high-impact economic events that can significantly influence the Forex market include:

- Central bank interest rate decisions and monetary policy statements

- Gross Domestic Product (GDP) data

- Inflation reports (Consumer Price Index, Producer Price Index)

- Employment data (Non-Farm Payrolls, Unemployment Rate)

- Retail sales and manufacturing activity reports

- Housing market indicators (Housing Starts, Existing Home Sales)

These events are typically scheduled and announced well in advance, allowing traders to prepare and plan their trading activities accordingly.

Considerations for Order Placement

When placing orders around major economic releases, it’s essential to consider the following strategies:

- Before the Event:

- Avoid opening new positions or increasing your leverage in the hours leading up to the event release.

- Consider closing or reducing existing positions to minimize your exposure to potential market volatility.

- Set wider stop-loss orders to account for the increased price swings that may occur.

- During the Event:

- Refrain from placing orders immediately after the event release, as the market can experience significant price gaps and volatility.

- Monitor the initial market reaction and wait for the dust to settle before considering new trade entries or adjustments to your existing positions.

- Use limit orders instead of market orders to manage your risk and ensure better trade execution.

- After the Event:

- Be patient and wait for the market to stabilize before executing new trades or making significant adjustments to your positions.

- Analyze the market’s reaction to the economic data and adjust your trading strategies accordingly, as the event’s impact may continue to influence the market in the short to medium term.

By understanding the timing and importance of high-impact economic events, and employing appropriate order placement strategies around them, traders can better navigate the increased volatility and uncertainty in the Forex market, potentially minimizing their exposure to undue risk and maximizing their trading opportunities.

FOREX GAP OPENINGS AND WEEKEND GAPS

The Forex market, being a 24-hour global market, can experience price gaps when the market reopens after periods of inactivity, such as weekends or holidays. Understanding the concept of gap openings and their impact on trade execution is crucial for Forex traders.

Explanation of Forex Gap Openings

A gap opening occurs when the current session’s opening price is significantly different from the previous session’s closing price. This can happen for several reasons, including:

- Weekend Gaps: The Forex market closes on Friday and reopens on Sunday (or Monday, depending on the time zone), during which time major news events or economic data releases can cause significant price movements, resulting in a gap opening.

- Holiday Gaps: Similar to weekend gaps, Forex markets may experience gaps when they reopen after holidays or other market closures.

- News-Driven Gaps: Unexpected or high-impact news events, such as geopolitical tensions or central bank decisions, can lead to significant price movements and gap openings upon the market’s reopening.

Potential Impact on Trade Execution

Gaps in the Forex market can have a significant impact on trade execution, as they can lead to:

- Slippage: When placing a market order, the trade may be executed at a price different from the expected price due to the market gap, resulting in slippage.

- Unfilled Orders: Limit orders or stop-loss orders placed during the previous session may not be triggered as expected due to the gap opening, potentially leaving positions unprotected.

- Increased Volatility: Gap openings often lead to heightened market volatility, which can make it more challenging to manage open positions and execute trades effectively.

Strategies for Managing Open Positions Over the Weekend

To mitigate the risks associated with weekend gaps, Forex traders can employ the following strategies:

- Reduce or Close Positions: Consider closing or reducing the size of your open positions before the weekend to limit your exposure to potential gap openings.

- Use Trailing Stop-Losses: Implement trailing stop-loss orders to lock in profits and automatically adjust your stop-loss levels as the market moves in your favor.

- Implement Wider Stop-Losses: If you choose to keep positions open over the weekend, consider setting wider stop-loss orders to account for the increased risk of gap openings.

- Utilize Limit Orders: Place limit orders instead of market orders when opening new positions before the weekend to better control your entry prices and manage the risk of slippage.

Understanding the dynamics of Forex gap openings and employing appropriate strategies to manage your open positions over the weekend can help you navigate the increased risks and uncertainties associated with these market events.

CONCLUSION

In the dynamic and fast-paced world of Forex trading, understanding the intricacies of the market’s trading hours and optimizing your order placement strategies are crucial for achieving success. By comprehending the ebb and flow of Forex market liquidity, the unique characteristics of each trading session, and the impact of major economic events, you can develop more effective trading approaches and better manage the inherent risks of the market.

Leveraging the increased volatility and liquidity during the overlap periods, timing your order placement around high-impact news releases, and managing your open positions over the weekends are just a few of the strategies covered in this guide. Mastering these techniques can help you capitalize on the opportunities presented by the 24-hour Forex market and improve your overall trading performance.

However, the journey to becoming a proficient Forex trader does not end here. Continuous learning, refinement of your strategies, and a disciplined approach are essential for sustained success in the markets. Stay up-to-date with the latest market developments, experiment with different trading styles, and regularly review and adjust your order placement techniques to adapt to the ever-changing Forex landscape.

Patience, discipline, and a commitment to ongoing education are the hallmarks of successful Forex traders. By embracing these principles and building upon the foundations laid in this guide, you can position yourself for long-term growth and fulfillment in your Forex trading endeavors.